About Us

IndyFi Ventures is the manager of the IndyFi family of funds. It is focused on providing an actively managed vehicle for institutional and high net-worth individuals in the high growth technology sector. We outperform the market through research, detailed due diligence, and a constant strive for alpha.

Our Philosophy

“Chancellor On Brink Of Second Bailout For Banks” – Satoshi Nakamoto, 2009, Block height 0.

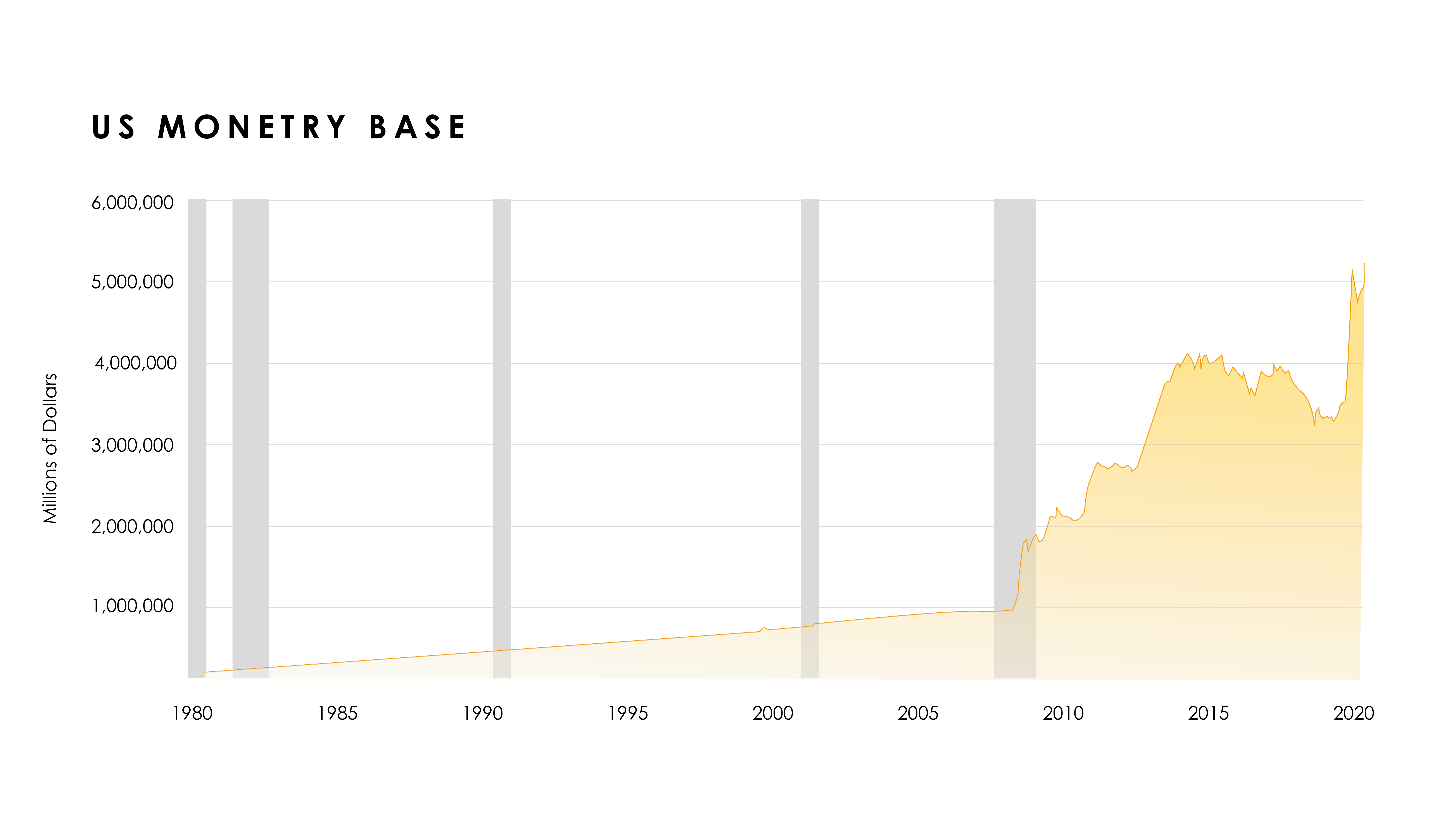

Never in the past 30 years have we seen the risks of centralization so clearly as we did in 2008. The global economy suffered devastating losses due to the greed and irrational exuberance of our too-big-to-fail financial institutions. The only solution was to print billions of dollars, doubling the monetary base of the US, to bail themselves out and prevent an economic meltdown.

At IndyFi Ventures we believe in the creation of a new, parallel financial system, where trust relies on the stability of cryptography and mathematics as opposed to the instability of governments and banks. This new system empowers the individual as information is shared peer to peer, removing middlemen. It’s Finance 2.0.

All of this will be built on a new computing platform: blockchain, the trustless substrate. By automating and outsourcing trust to technology, we have for the first time in human history a decentralized, and therefore free exchange of value between two parties. This is revolutionary in ways we can’t even imagine. We believe we will see decentralized and trustless applications not only for exchange of value, but also for reputation, identity, and things we have yet to imagine.

Trustless computing is the next big wave, come surf it with us.

Core components required for a new financial system

Privacy is a human right and business necessity. As of yet, bitcoin is not private as every transaction can be tracked on the blockchain.

Smart Contracts are a key component for building more advanced features needed in the new financial system such as derivatives and prediction markets.

Stablecoins are cryptographic coins that have most of the attributes of bitcoin or ether but without the volatility. Its value is typically pegged to the dollar, euro, gold, or a basket of currencies. They have the potential to become a medium of exchange, a unit of account, and the base for building more complex financial instruments on the blockchain.

Tokenization allows us to bring traditional assets to the world of crypto, such as stocks, REITs, and bonds, making custody, transfer, and post-trade more efficient and globally accessible.

Identity and reputation are the cornerstone of some of the most important financial products. It allows lenders and service providers to forecast behavior, enabling everything from business loans to home rentals.

Decentralized exchanges, sidechains, and Layer 2 solutions are needed to make the new financial system run smoothly.

Our investment methodology

Crypto markets are a hydra – it’s venture capital investing with public market liquidity. Our investment process is broken into two parts: the venture capital side, and the public market liquidity. We harness both elements to deliver alpha.

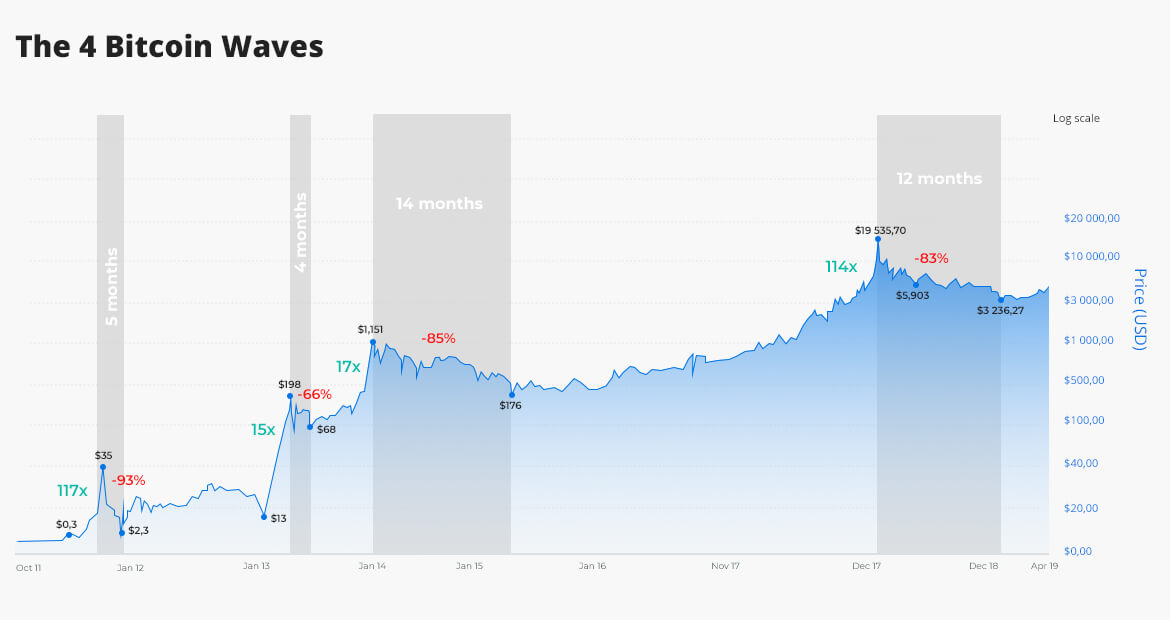

Liquidity: Most of our assets have unlimited liquidity and we understand that crypto is a boom and bust market. So, in our combined decade+ of experience in crypto markets, we have come up with a series of rules which we constantly refine to determine when to increase and decrease exposure to crypto assets by identifying the part of the cycle we are in.

The investment process begins by identifying the key components needed to build a new financial system. By doing this, we narrow down the projects. We then select the most promising ones and do detailed due diligence, including talking to founders and development teams. We then factor our liquidity rules and begin the accumulation of the asset.

The main goal is to create a methodic system that delivers alpha.

Have a worthy addition?

Gain exposure to finance 2.0

Find out more about how you can gain early-stage exposure to this emerging market.